一張債劵面額100元,如果我認知沒錯就是1000元美金,折合3萬多台幣

債劵有時折價有時溢價...

你買的時候是買張 還是 買金額??

假設你有10萬美金,面額100元就是1000元的債,你可買100張

但如果面額是105元就是1050元,你...是買95張整數,還是95.2張,還是95.238...張

還是他們不用張數計算??

還有下單金額有1萬美元的嗎--最低消費是多少美元?

askking wrote:

一張債劵面額100元...(恕刪)

上面寫的怪怪的......其實你買的是"單位"

以前跟券商 or 銀行買, 最小金額是3萬美金......最近券商推出小金額一萬美金就可以買

實際上你下單的最少是100美元(票面價)X100單位=10000美元

你最少一次要買100單位

因此.....你買某企業債報價是100元, 就是付100元X100單位=10000美元+上手息(假設50元).....實際扣款10050元

假設你要買105元的企業債, 付的金額就是105元X100單位=10500美元+上手息(假設50元).....實際扣款10550元

假設你對垃圾債有興趣, 價格是60元, 實際只要準備60元X100單位=6000美元+上手息(假設50元).....實際扣款6050元

這樣說明清楚嗎?

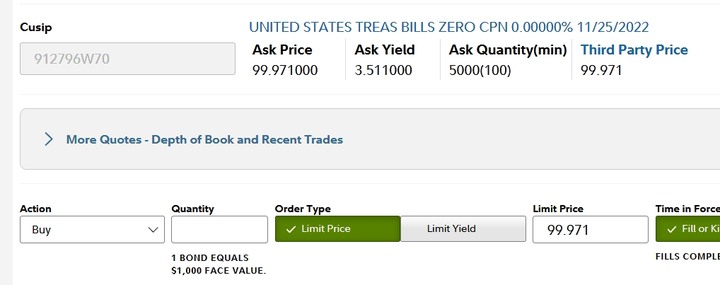

When you're viewing a Treasury quote, select the tab labeled "Price and Performance" and then select "Depth of Book." Here, you can see the order book for the issue, which displays any other quotes that are present in the market. This may or may not include smaller minimum quantities. Often times, orders containing a smaller quantity of bonds have lower Bids and higher Asks.

Treasury Bid/Ask spreads are displayed for a certain quantity for bonds. In the first example you gave, the quote is written as:

108.653 / 109.150

10,000(200) / 10,000(200)

That means that you'd have to buy at least 200 bonds to receive an Ask price of $1091.15 per bond. The 10,000 is showing that there are a total of 10,000 available for purchase.

As you mentioned, bonds and other fixed income products can be purchased in increments of $1,000, so 1 bond = $1,000. Therefore, you are able to buy or sell bonds at a lower quantity than what is displayed in the bid/ask quantity on the trade ticket, provided there is a market for the security. However, the price shown in the quote represents the price for the quantity shown. Buying or selling less than the detailed quantity can affect the price you pay.

無良網管..系統正在準備文章內容, 請稍待...

內文搜尋

X