我在6/10出場了.

局勢渾局勢,天災不斷...

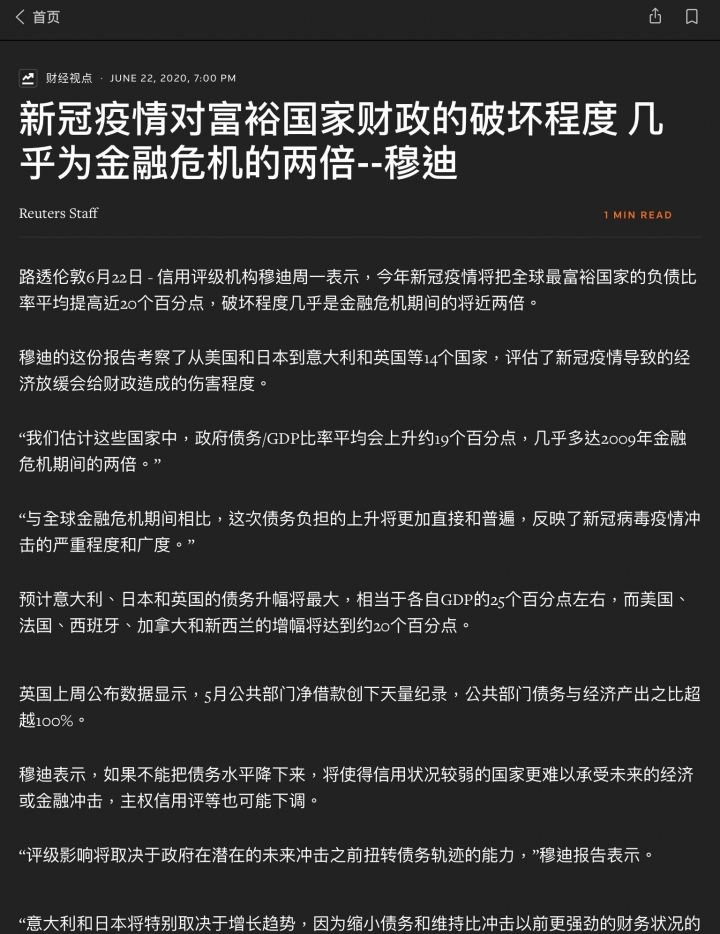

世界上兩大經濟體,美國的老百姓有30%付不出房貸.

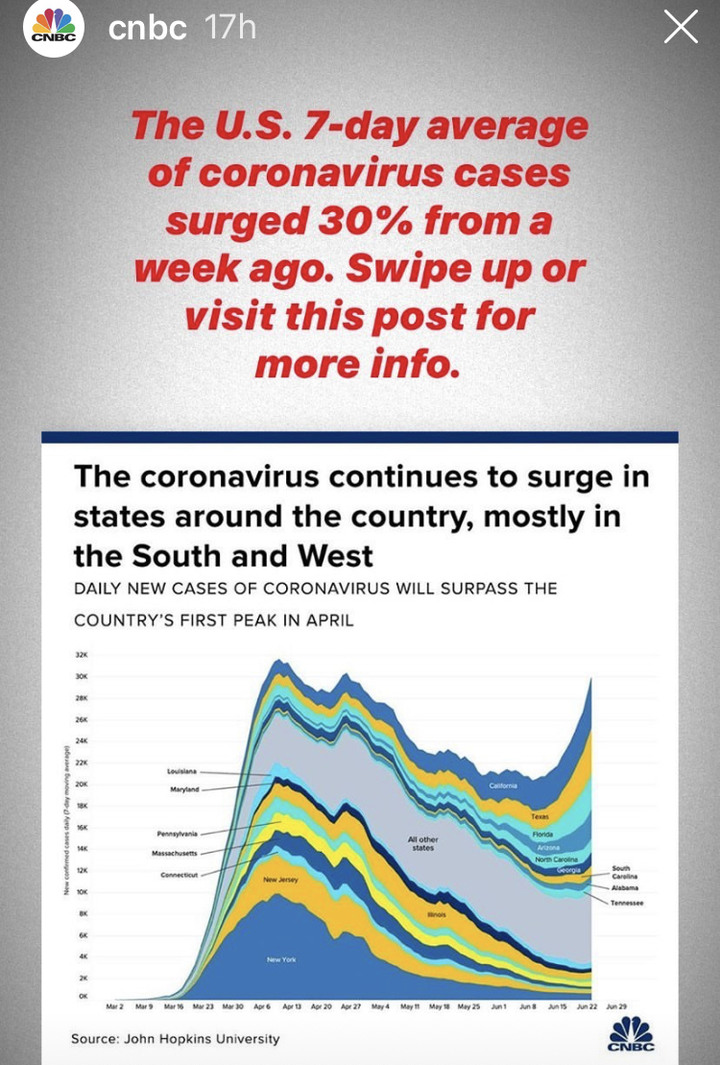

病例急升

再想想中國從北京開始,疫情又面臨失控,

外加百年一遇的大洪災,蔓延近十個省份...

歐洲疫情也逐漸升溫,第二波疫情來襲.

新加坡每日新增病例以 "百"為單位,東南亞各國皆然.

實體經濟這麼困難,全球失業率創新高,而股市卻是在歷史高位?

The Fed’s announcement came as the central bank released the results of 2020 stress tests mandated under the Dodd-Frank Wall Street reform law passed in the wake of the 2007-09 financial crisis.

The Fed tested banks on their ability to weather two hypothetical scenarios — a baseline of typical economic conditions and a “severely adverse scenario” — and three coronavirus-specific situations: a V-shaped recession and recovery; a slower, U-shaped recession and recovery; and a W-shaped, double-dip recession.

While the 33 banks subject to the 2020 Fed stress tests met the standards to prove they would be able to retain enough capital to stay solvent through a deeper crisis, the Fed said several banks came close to the minimum levels of cash reserves mandated by Dodd-Frank.

For that reason, the Fed is ordering banks to suspend any planned stock buybacks during the third quarter of 2020 and capping the size of dividends for at least that time.

沒差...它們不能庫藏股...就是我買入的好機會

銀行/非壽險保險公司基本上是無本生意

第三季不能買回自家股

不能增加股息

不像鳥英國..直接停息到年底

無良網管..系統正在準備文章內容, 請稍待...

內文搜尋

X