2022年公司業績大好,利潤也飆高,主要原因來自於InP HBT及InP PIN量產出貨順暢。

公司在經過2018年中美貿易戰後的轉型,營收分布上InP已成為量產主力產品,將近40%以上營收為InP,其中若順利量產又以HBT (高頻) > PIN (高速) > APD (研發+小量訂單)。因此,HBT+PIN不好,公司業績就不會很好,而這兩個產品公司在這次都沒有給出很明確的訂單展望,因此,月營收數持續低迷似乎是可預見的,而因為4月營收開出來,公司已經虧掉一千多萬,我預計整個Q2開出的EPS可能是小虧或打平,2023H1將類似2020年H1的情況。

這次給出較好展望的部分,是在GaSb和機台部分。

GaSb產品雖然是公司的明星產品,但目前量產機台仍然有限,且營收占比仍低(遠小於20%,甚至還沒有獨立呈現),公司估計要過一兩個月後才會持續讓新機台加入量產,因此一兩個月內GaSb的量產單還看不到明顯增長,另一方面因為占比偏低因此對整體營收貢獻有限,但確實有機會提高公司毛利率表現,我們還沒有看過GaSb訂單全力生產後的財務表現長甚麼樣子,接下來Q2和H2似乎可以期待一下這部分。公司有提到一個新項目是夜視增強顯示器,即美國陸軍未來會採用的ENVG-B (L3 Harris供應),公司參與的應該是下一代的產品,即將感測器置換成GaSb。可參考https://www.youtube.com/watch?v=-FMDJDlYb3o

而機台的部分,12吋GaN on Si機台的開發,可能是跟應用材料(applied material)一起開發,主要是為了矽晶圓廠(台積電、格羅芳德等等等這些公司)在研發,還有三部以上的MBE機台更新訂單等,聽起來都還有一段路要走,明確的機台出貨日跟營收入帳認列可能要到Q3-Q4法說才會比較明朗。

GaAs的部分,存在感越來越低,甚至已經擺到GaN後面去談了,所以暫時也不太需要重視這一塊,除非VCSEL的中國客戶有回來或是這方面有其他新應用、新訂單。

整個美國光通訊產業因為華為禁令,這一兩年歷經整併後,剩下的公司沒幾家了,例如公司供應的Finisar已經和II-VI合併,後續又合併了Coherent,Lumentum那邊也收購了很多小的公司例如Neophotonics等,競爭態勢逐漸明朗起來,研究起來也變得容易,但看了大家的展望,全部都對今年的營運表示很不樂觀

從聯亞的營收迭迭下滑,今年5月剛開出來只剩6000萬,也可以知道整個上游市場是真的越來越愁雲慘霧。即便是去年接到蘋果消費性訂單的聯亞,今年一掉FaceID量產單,稼動率不足的結果就是,去年的機台跟廠地投資全都成了財報上的嚴重負擔。

英特磊公司目前的情況就是看InP,看InP就是看光通市場跟量測市場,量測市場的客戶Keysight相對比較好一點,但由於不確定公司實際上供應的InP HBT是用在Keysight的哪一類產品上,因此實際上Keysight對上游拉貨的情形是不是有辦法拉動英特磊下半年的營運,還有待觀察。

今年公司(整個產業)營運的能見度非常低,但投資計畫聽起來是不手軟,如果未來兩年景氣沒有好起來,且沒有拿到如預期的美國晶片法案的補助比例的話,那從今年開始的大舉投資很可能成為公司未來五年的負擔。

15 June 2023

IntelliEPI and Riber MBE 8000 joint development program shows high thickness and doping uniformities across 8x6” or 4x8” wafer runs

Milestones have been announced in the joint development program between Intelligent Epitaxy Technology Inc (IntelliEPI) of Richardson, TX, USA – which manufactures MBE-grown epitaxial wafers – and Riber S.A. of Bezons, France – which makes molecular beam epitaxy (MBE) systems as well as evaporation sources – regarding qualification of the latter’s new MBE 8000 production platform.

As Riber’s new flagship, the MBE 8000 is reckoned to be the highest-capacity MBE production tool available on the market, able to handle batches of eight 150mm (6-inch) or four 200mm (8-inch) wafers. The design benefits from over 20 years’ experience in production MBE systems running daily around the world, enabling what is claimed to be outstanding process performances and stability, and thus reducing cost of ownership.

Following the delivery of the first MBE 8000 platform and thorough qualification work in close cooperation with IntelliEPI, results have exceeded expectations for such technology, particularly in terms of uniformities, defect densities, increasing yield, and interface abruptness, which is key for superlattice structures to achieve high-performance lasers.

The performance, combined with a high level of run-to-run repeatability control in large-scale production, will enable a new generation of lasers, particularly for the fast-growing vertical-cavity surface-emitting laser (VCSEL) sector, with significant market opportunities in the field of smartphone under-display facial recognition.

In its latest report on VCSELs, market research firm Yole Group states: a “major change expected is a shift in wavelength from 940nm to 1380nm… to achieve an integration of the VCSELs behind organic light-emitting diode (OLED) displays, which are transparent at this wavelength. The first application could be the proximity sensor being placed under the display…”

In addition to the VCSEL market, the precise control of doping uniformity and the processes stability offered by the MBE 8000 platform can also enhance microelectronic device performances, such as conductivity, says Riber.

Over the past few months, as results were disclosed to several industrial customers, interest in the machine has grown quickly, leading to discussions for potential purchase, Riber adds.

“From the initial evaluation so far, this Riber MBE 8000 has shown very impressive performance in terms of being able to produce high-quality epi materials over such a large substrate platen area, with excellent composition and thickness uniformity across the 8x6” platen,” comments IntelliEPI’s president & CEO Yung-Chung Kao. “With this improvement, the MBE 8000 platform offers a solution to make large-scale production MBE technology more competitive, especially for high-performance and high-throughput market opportunities,” he adds.

“Thanks to the efforts of Riber and IntelliEPI teams, we have reached a major step for MBE 8000 qualification. The results provided by the machine exceed our initial objectives,” states Riber’s CEO Christian Dupont. “With an optimum cost of ownership and large capacity, the MBE 8000 equipment has strong commercial prospects,” he believes. “In addition, our milestone in this joint development program with IntelliEPI demonstrates the capability to bring MBE technology in high-volume semiconductor industry.”

台美跨境投資 台商減稅有望

工商時報 傅沁怡 2023.07.18

勤業眾信聯合會計師事務所稅務部國際租稅主持會計師廖哲莉指出,現行法規下,台商美國子公司匯出股利、利息、權利金適用30%扣繳率。草案將利息及權利金扣繳率調降至10%;股利則依照持股比例及期間不同,分別適用10%或15%扣繳稅率。

心得:

公司穩定的經營,總會有好事發生。股利的稅率調整,或是能夠買進二手機台轉而出售,又或者能夠申請晶片法案,獲得短期內擴張的動能。這些都是公司能夠存活下去,等到產品出現爆發性應用的武器。即使短期遇到逆風,也無訪。我覺得公司爆發的機會就是等待mm wave/ 6G PA的應用出現,目前看來是逐步的擴充機台,與招募更多員工,等待順風的來臨。

第二代.第三代半導體下游廠商的原料缺貨恐慌潮.在業界逐漸蔓延.

下游廠商擔心第三季磊晶需求旺季迫在眼前.

若無貨可用將面臨一整年的旺季泡湯.

中游磊晶廠全新(2455)已遭到擔心漲價的下游客戶搶貨.

預計將反映在8月後業績一路狂漲.....

法人評估受惠這波管制引發的不理性搶貨潮.

將使磊晶廠第四季業績異於往年慣例.強壓第三季奪冠.

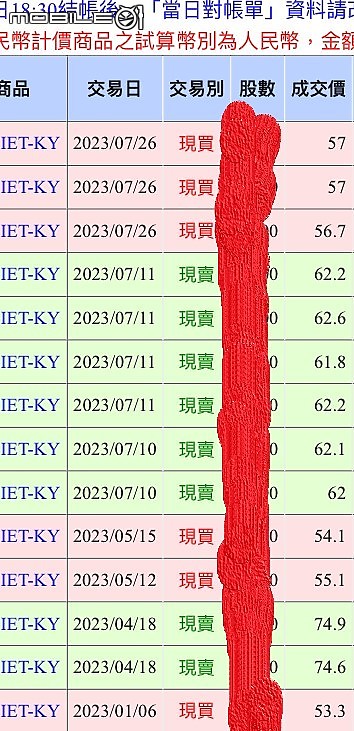

IET-KY 英特磊(4971)為這波被中國管制最多稀有金屬項目的美國頭號眼中釘

其供應的軍工用磊晶產品.廣達北美/中東/歐洲/亞洲等各國.

涵蓋國家及廠商世界第一.更為美國第二代.三代半導體磊晶大廠.

首當其衝.也傳被客戶要求給貨補足超額庫存.

未來搶貨潮將蔓延到聯亞(3081).全訊(5222)接棒.受惠最後一波搶貨買氣.

英特磊在近日表示.未來不排除以持續漲價.

來抑制客戶的搶貨狂潮無限蔓延.

內文搜尋

X