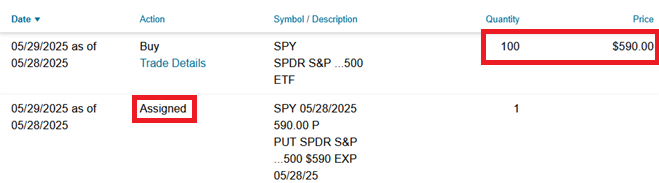

用 $590 的PUT 買回,明天看來又反向上漲了。

$587 入手,$591 被Call,$590 用PUT 買回來,立刻漲到$596

只有玩這種一口的時候才運氣好,真的是有夠無言的。

要是有五十口的話。。。。。

A new acronym to describe President Donald Trump's trade war tactics is gaining popularity among Wall Street investors, much to the president's disdain.

Here's what to know about "TACO" and tariff negotiations.

The term TACO, which stands for "Trump Always Chickens Out.” First coined by Financial Times commentator Robert Armstrong to describe what he says is Trump’s pattern of announcing heavy tariffs on countries causing economic shock, panic and stock market hits and then later reversing course with pauses or reductions that create a market rebound.

Apple 1+2 wrote:

請問拍照大,...(恕刪)

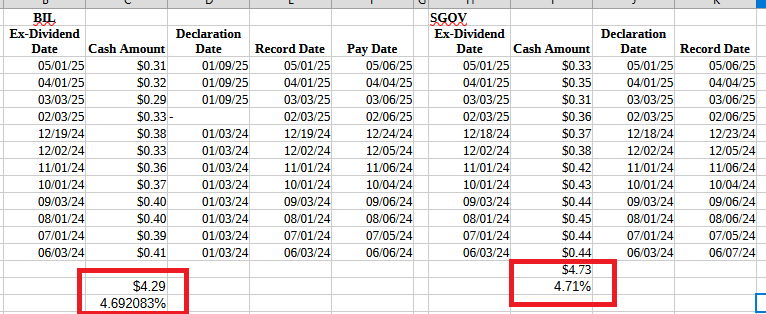

The main difference between treasury bills (T-bills), notes (T-notes), and bonds (T-bonds) lies in their maturity and how they pay interest. T-bills are short-term, maturing within a year or less. T-notes are medium-term, maturing in 2 to 10 years. T-bonds are long-term, maturing in 20 or 30 years. Additionally, T-notes and T-bonds pay semi-annual interest, while T-bills are sold at a discount and the interest is the difference between the purchase price and the face value at maturity.