他的確是傑出,但絕對不是股神.

失敗的投資很多,google一下Tesco,IBM...而且虧損都是幾十%.

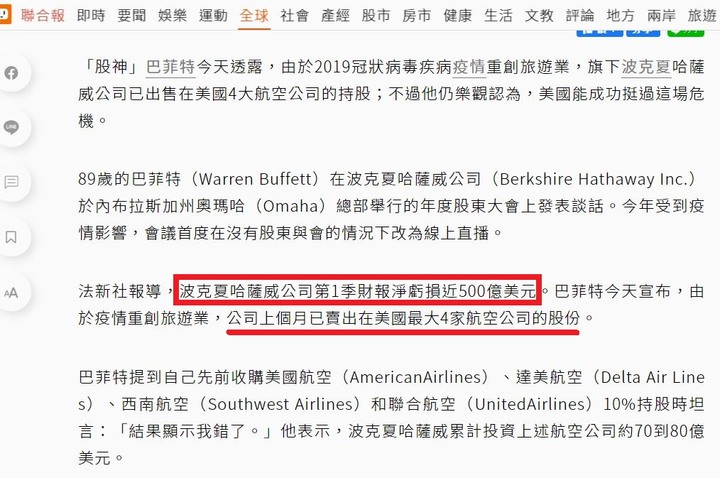

再看看自去年下半年狂敲美國四大航空公司股票,

其中達美航空甚至已經位列第一大單一股東.

去年下半年從US$60+開始買,

一直到今年二月份還在加碼攤平,US$45+持續增持.

武漢肺炎疫情大爆發,Delta股價已經狂瀉20%.

巴菲特沒有停損,卻是持續加碼.

結果呢? 隔不到一個月,在三月份股市最低點時,全數認賠殺出.

現在四大航空公司收盤價遠高於巴菲特停損的價格.

這是不是典型的追高殺低呢?

是誰說如果沒打算持有10年,就連一天也不要持有?

二月份最後加碼攤平的均價約US$45.00,外加去年底US$60+高價買入的價格,

結果卻在US$22.96-US$26.04之間出脫.

在股市最低迷之際,出脫四大航空股票.

Delta Airline這檔股票,虧損接近70%以後,才停損.

https://finance.yahoo.com/news/warren-buffet-berkshire-hathaway-divests-104213818.html

Berkshire sold about 13 million Delta shares on Wednesday and Thursday priced between $22.96 and $26.04, according to SEC filings. Separately, Buffet’s Berkshire also divested about 4% of its stake in Southwest Airlines Co. (LUV) dumping about 2.3 million shares for about $74 million, SEC filings show. Delta shares, which were trading around $59 at the start of the year, slid 0.1% to $22.48 on Friday.

內文搜尋

X