可惜今天已經沒錢加碼

換股的動作如果晚1/2天會更漂亮

均價換到$24.52

ALLY-A

Call Risk: Collins Amendment, Tier 1 Capital Treatment, and Dilution

One of the effects of the 2010 Collins Amendment was to eliminate trust preferred securities (TruPS) as an element of Tier 1 capital. In other words, TruPS securities would be considered as Tier 2 (subject to a multi-year phase-in period), which is a lesser form of eligible bank capital.

However, the Amendment did include some grandfathering language beneficial to banks like Ally. Specifically, debt or equity instruments issued to the Federal government, or any of its agencies, before the end of the Treasury’s authority to invest via TARP on October 4, 2010, are exempt from the Collins Amendment. The exemption explicitly and permanently grandfathers all TARP preferred issuances, regardless of the size of the institution. GMAC Capital Trust I is a TARP preferred security, whose origin commenced prior to October 4, 2010, and thus is included in Ally’s Tier 1 capital calculation. A recent email from investor relations confirmed that its TruPS issue was grandfathered and is being treated as Tier 1 capital.

Not losing the Tier 1 designation is important to Ally and thus they’ll not want to retire GMAC Capital Trust I unless they can replace it with another, possibly less expensive Tier 1 instrument like common equity shares. However, they’ll most likely not do this because:

The amount to replace GMAC Capital Trust I is relatively small: $2.5B versus Ally’s $12.5 billion market cap.

Issuing new common equity to replace it would dilute existing shareholders.

Retiring it would not increase EPS (as would a common stock buyback)

They’ll need regulatory approval from the Fed

Thus, the risk of GMAC Capital Trust I being called early, even as yields continue to fall, appears fairly remote.

無良網管..系統正在準備文章內容, 請稍待...

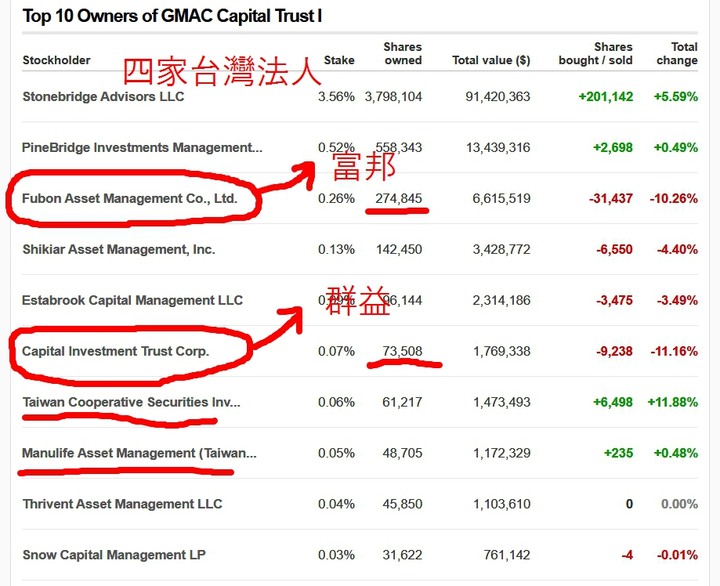

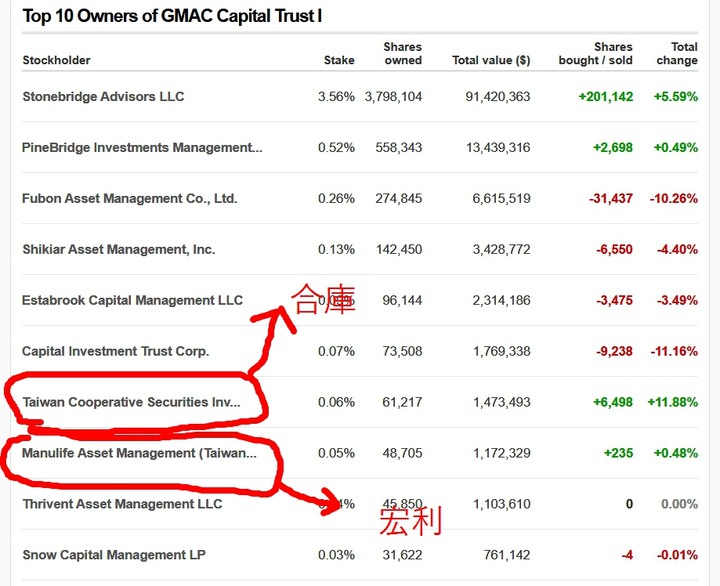

越查越扯

宏利投信Manulife Asset Management (Taiwan

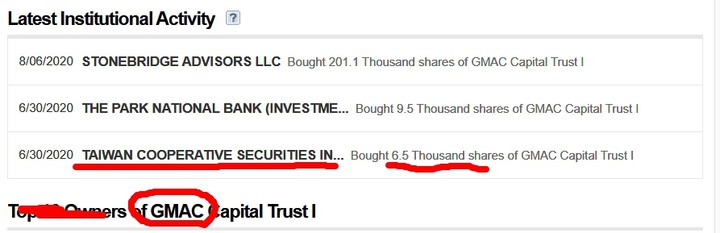

合作金庫TAIWAN COOPERATIVE SECURITIES IN.

也買

富邦剛剛看到

我也真是的

大筆買完才在查資料

還好直覺還算正確

只是進場早了1/2天

子彈也耗盡...也換了10K股..均價還過高了一點點! $24.52

如果3個月libro rate是0..殖利率最低也有5.785%*(25/24.52)=5.898%

無良網管..系統正在準備文章內容, 請稍待...

tcwu wrote:

One of the effects of the 2010 Collins Amendment was to eliminate trust preferred securities (TruPS) as an element of Tier 1 capital. In other words, TruPS securities would be considered as Tier 2 (subject to a multi-year phase-in period), which is a lesser form of eligible bank capital.

也持有Ally-a ,但成本不像tcwu大換股成本更低。

這篇新聞似乎對GMAC Capital Trust I 不利,可惜股價沒跌太多,

近來好標的都好貴啊!

tadpole08 wrote:

也持有Ally-a (恕刪)

是好新聞ALLY-A雖然不能當TIER 1但可以當TIER 2資本

所以ALLY 比較不會有CALL的動作..ALLY也不用另籌資本應付金檢

除非利率升的過高+5.785% ALLY受不了才會CALL

有很大機會很長時間都不贖回

我是用賺來的錢去換他

實際成本價應該很低..絕對低很多

然後我知如果市價回到26..我可能又會去換新的IPO

除非IPO的%太低..

被富達菜鳥惡搞

我電話下單她沒辦法下單害我錯過UZD

我25多沒換到現在已經26多還不到10天吧

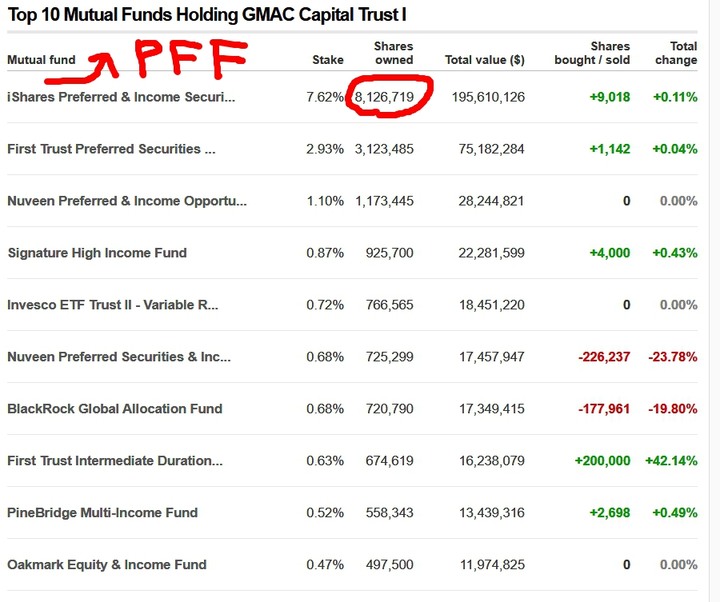

這些都是非投資級但是被法人/ETF搶購的怪咖

PFF從7/15號後已經累積買了15萬股ALLY-A回來

無良網管..系統正在準備文章內容, 請稍待...

現在回頭看

可能換錯一隻股

我的AVGOP應該不要換掉

因為太晚去研究PFF

知道其中的"眉角"時已經是七月中以後的事了

AVGOP8/26/2020股價也到了$1233.47的新高

這是面額$1000三年期轉換型8%股息的優先股

AVGOP現在不只是單純地回到我最後一次殺進去的價格還突破我賣出的高點

現在回頭看

可能換錯一隻股

我的AVGOP應該不要換掉

因為太晚去研究PFF

股災前東問西問..沒人回答我

七月中卻被我在PFF找到答案...

找到解答也太晚....

AVGOP有可能還會創新高..1300/1400的股價都有可能

答案就在PFF中..自己去挖寶..

這一隻不要換如果堅持我自己說的

優先股跌不是真跌..只有不發息才會完蛋...

我現在就不會後悔..有可能少了一個賺更多的機會

真的是匆忙之下來個大洗盤

雖然錢都賺回來但是...

AVGOP到期轉換時我有可能賺更大

這個AVGOP只好做罷..無緣

現在差別只是賺多賺少而已....

只能來這發牢騷..安慰自己一下...

優先股這玩意..太深奧

無良網管..系統正在準備文章內容, 請稍待...

內文搜尋

X